(P127) State income tax forms present an annual opportunity to grow the Organ Donor Registry

Location: Platinum Ballroom

Poster Presenter(s)

Aim: A major challenge to deceased donor transplantation is the need to secure authorization for donation. Authorization rates in Michigan are far higher if the donor joined the Organ Donor Registry (87% in 2023) than if authorization was required from the donor’s family (34% in 2023). Therefore, growing the Donor Registry is a critical factor in increasing the number of organs available for transplant.

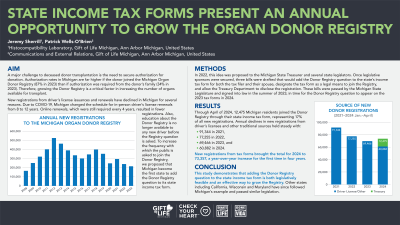

New registrations from driver’s license issuances and renewals have declined in Michigan for several reasons. Due to COVID-19, Michigan changed the schedule for in-person driver’s license renewals from 8 to 12 years. Online renewals, which were still required every 4 years, resulted in fewer registrations. Also, education about the Donor Registry is no longer available to any new driver before the Registry question is asked. To increase the frequency with which the public is asked to join the Donor Registry, we proposed that Michigan become the first state to add the Donor Registry question to their state income tax form.

Method: In 2022, this idea was proposed to the Michigan State Treasurer and several state legislators. Once legislative sponsors were secured, three bills were drafted that would add the Donor Registry question to the state’s income tax form for both the tax filer and their spouse, designate the tax form as a legal means to join the Registry, and allow the Treasury Department to disclose the registration. These bills were passed by the Michigan State Legislature and signed into law in the summer of 2023, in time for the Donor Registry question to appear on the 2023 tax forms in 2024.

Results: Through the first quarter of 2024, 6,982 Michigan residents joined the Donor Registry through their state income tax form, which represented 13% of all new registrations. Annual declines in new registrations from driver’s licenses and other traditional sources held steady with 65,904 in 2021, 57,879 in 2022, 52,296 in 2023, and 45,360 in 2024. The addition of new registrations from tax forms brought the Q1 total for 2024 to 52,342, a year-over-year quarterly increase for the first time in four years.

Conclusion: This study demonstrates that adding the Donor Registry question to the state income tax form is both legislatively feasible and an effective way to grow the Registry. Other states including California, Wisconsin, and Maryland have since followed Michigan’s example and passed similar legislation.

New registrations from driver’s license issuances and renewals have declined in Michigan for several reasons. Due to COVID-19, Michigan changed the schedule for in-person driver’s license renewals from 8 to 12 years. Online renewals, which were still required every 4 years, resulted in fewer registrations. Also, education about the Donor Registry is no longer available to any new driver before the Registry question is asked. To increase the frequency with which the public is asked to join the Donor Registry, we proposed that Michigan become the first state to add the Donor Registry question to their state income tax form.

Method: In 2022, this idea was proposed to the Michigan State Treasurer and several state legislators. Once legislative sponsors were secured, three bills were drafted that would add the Donor Registry question to the state’s income tax form for both the tax filer and their spouse, designate the tax form as a legal means to join the Registry, and allow the Treasury Department to disclose the registration. These bills were passed by the Michigan State Legislature and signed into law in the summer of 2023, in time for the Donor Registry question to appear on the 2023 tax forms in 2024.

Results: Through the first quarter of 2024, 6,982 Michigan residents joined the Donor Registry through their state income tax form, which represented 13% of all new registrations. Annual declines in new registrations from driver’s licenses and other traditional sources held steady with 65,904 in 2021, 57,879 in 2022, 52,296 in 2023, and 45,360 in 2024. The addition of new registrations from tax forms brought the Q1 total for 2024 to 52,342, a year-over-year quarterly increase for the first time in four years.

Conclusion: This study demonstrates that adding the Donor Registry question to the state income tax form is both legislatively feasible and an effective way to grow the Registry. Other states including California, Wisconsin, and Maryland have since followed Michigan’s example and passed similar legislation.